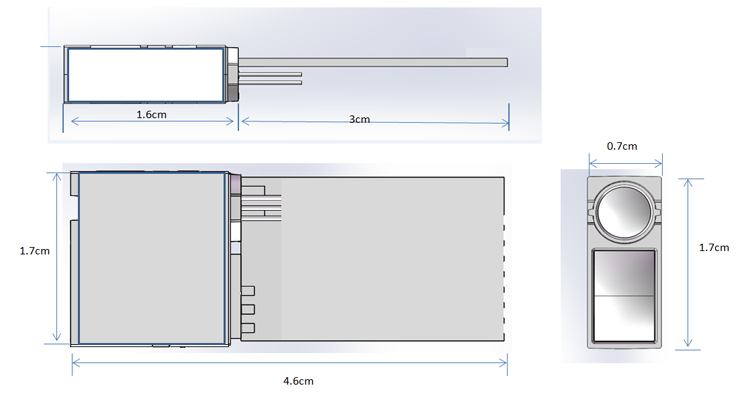

IT02S, is JRT new product in the early 2019, which is a single-point LiDAR sensor, also called tof distance sensor. With a micro size of 46x17x7mm, customers can widely use in many Laser Measurement Solutions. The lidar distance sensor can measure 12m short-range with high frequency up to 100hz. It's great for Unmanned Aerial Systems. If you need us send you data sheet and spec for this products, offering sample as well, pls tell us, thank you.

Accuracy

+/-8cm@ 0.1~3.5m

Measuring Unit

cm

Measuring Range (without Reflection)

0.1-12m

Measuring Time

0.1~3 seconds

Measuring Frequency

100 Hz

Laser Class

Class II

Laser Type

650nm, <1mw, red

Weight

About 5g

Voltage

DC2.5V~+3.5V

Serial Level

TTL 3.3V

Size

46*17*7mm

Operating Temperature

0-40 ℃ (32-104 ℉ )

Storage Temperature

-25~60 ℃ (-13~140 ℉)

2D Laser Distance Sensor,2D Lidar Sensors,Tof Lidar Distance Sensor, Flight Distance Sensor Chengdu JRT Meter Technology Co., Ltd , https://www.cdlaserdistancemeter.com

According to theoretical analysis, the total capacity of erythromycin thiocyanate in China has exceeded the 10,000-ton mark a few years ago. However, in fact, last year, the total output of erythromycin thiocyanate in China was only 5,000 to 6,000 tons. Less than 50% of the national total capacity. The domestic erythromycin thiocyanate market has a balance between basic production and sales, and presents a large market gap.

At present, the largest erythromycin thiocyanate manufacturers in China are: Qiyuan Pharmaceutical of Ningxia, Sichuan Shanshan Pharmaceutical, Hubei Yidu Dongsun Biochemical Pharmaceutical, Henan Xinxiang Huaxing Pharmaceutical and Xi'an Lijun Pharmaceutical Group. At the same time, some other companies have newly built or expanded erythromycin thiocyanate production lines. With the expected increase in production, the market price of erythromycin thiocyanate will gradually stabilize.

The trend of demand does not diminish In 2003, China produced a total of 900 tons of erythromycin thiocyanate, of which 560 tons were exported, accounting for about 62% of the annual output, and accounted for about 55% of the total domestic exports of macrolide drugs. In 2004, China produced a total of 1,180 tons of erythromycin thiocyanate, of which 620 tons were exported and the export value increased by 32% over the previous year. In 2006, China's exports of azithromycin and erythromycin thiocyanate accounted for 60% and 26% of exports of macrolide antibiotics, respectively, of which exports of erythromycin thiocyanate exceeded 1,000 tons for the first time, reaching 1,172 tons. As of 2007, the data show that the domestic production capacity of erythromycin thiocyanate has reached 8,000 tons.

Since 2009, the domestic demand for erythromycin thiocyanate in the downstream industry has soared, and the increase in the number of exports has made the prices of erythromycin thiocyanate bulk drugs in the domestic market continue to rise for three consecutive years. At the beginning of 2009, the domestic market price of erythromycin thiocyanate was only 300 yuan per kilogram, and it had risen to 400 yuan by the end of the year, and rose to 450 yuan per kilogram in March 2010. At the end of 2010, it was closer to the high of 500 yuan, but it still did not reach the historical high of 1,000 yuan/kg.

At the same time, the export volume of erythromycin thiocyanate also increased for three consecutive years. In 2009, it increased by 23% compared with 2008. In 2010, it increased by about 25% from the previous year. This shows that the demand for erythromycin thiocyanate in the international market is also increasing. It is predicted that the demand for erythromycin thiocyanate in the international market will continue to maintain its growth momentum in the next three years.

Before 2005, China’s exports of erythromycin thiocyanate to India, Malaysia, and other Southeast Asian countries accounted for about 77% of China’s total exports. In recent years, with the market of Brazil, Russia, and the United States, The demand for erythromycin has increased year by year. The above-mentioned countries have become new export markets for erythromycin thiocyanate in China and the number of exports is also increasing. However, as a whole, due to the fact that exports of erythromycin thiocyanate are not as good as domestic sales, most domestic companies are willing to sell erythromycin thiocyanate bulk drugs in the domestic market. Although there is a huge demand in the international market, the number of domestic exports cannot be too large. It is reported that the price of erythromycin thiocyanate in the international market is about 100 to 120 US dollars.

Fermentation Technology Limits Production The current rumors of erythromycin thiocyanate market are bullish due to the following three factors:

The first is the existence of barriers to the fermentation technology of erythromycin thiocyanate, which has limited production. To date, erythromycin thiocyanate is a pure fermentation product and cannot be artificially synthesized. In addition, the thiocyanate erythromycin contains highly toxic thiocyanate in the waste liquid, causing serious environmental pollution and high processing costs. Even old companies with more than 50 years of mature fermentation production experience, such as North China Pharmaceuticals, do not dare to easily launch erythromycin thiocyanate bulk drugs. According to industry sources, the level of fermentation of erythromycin thiocyanate fluctuates, and the yield of products fluctuates, and it is difficult to stabilize unless there is a high-yield strain. Ningxia Qiyuan Pharmaceutical and other manufacturers can occupy the mainstream of erythromycin thiocyanate raw material production, largely related to its fermentation technology. It is not easy for a newly launched company to achieve the fermentation level of the aforementioned five companies.

Second, China’s export of erythromycin thiocyanate has increased for three consecutive years, which is another factor that caused the tight supply of erythromycin thiocyanate in the domestic market. Previously, China's main export markets for erythromycin thiocyanate were in India and Southeast Asia, and have now expanded to markets such as the United States, Brazil, Russia, and Latin America. In addition to the export of India's erythromycin thiocyanate is used to produce downstream erythromycin preparations such as clarithromycin, other countries that import erythromycin thiocyanate in China are basically used as veterinary antibiotics. In the past few years, due to the difficulty in solving environmental problems, erythromycin thiocyanate raw materials in the United States, Russia, and other industrial countries have all ceased production and have been imported from China. They compete with domestic enterprises for erythromycin thiocyanate raw materials, resulting in domestic supply. Tension. In addition, the quotations of erythromycin thiocyanate in China are at least 30% to 40% lower than the quotations of similar products from Dutch DSM and German Hearst Company. Therefore, more and more foreign merchants adopt China's thiocyanate red. The raw material medicine of the mycin is to replace the European product.

The biggest contributor to the domestic supply of erythromycin thiocyanate is the rapid growth in demand for this drug substance in the domestic downstream erythromycin industry. In particular, the three new generations of erythromycin preparations such as azithromycin, clarithromycin, and roxithromycin cannot be separated from the erythromycin thiocyanate bulk drug substance. From 2008 to 2009, the market size of anti-infective drugs in China was 50 billion yuan/year, of which macrolide drugs accounted for about 4% of the total market. There are about 17 varieties of macrolides in China. There are about 10 varieties with a production capacity of 100 tons or more. In 2009, the production of macrolides (including intermediates) was estimated to exceed 9,500 tons. The main growth was due to the clinical needs of roxithromycin, azithromycin, and clarithromycin. Currently, these three drugs have been occupied by hospitals. About 90% market share of macrolides.

Some industry sources estimate that raw materials for azithromycin, clarithromycin, and roxithromycin will increase 25.57%, 5.82%, and 18.74% year-on-year in 2010.

The pace of expansion has accelerated Since erythromycin thiocyanate has been out of the shadow of years of slow-moving sales, the pace of production expansion by domestic manufacturers of erythromycin thiocyanate is accelerating.

It is understood that the fourth phase of the erythromycin thiocyanate project of Hubei Yidu Dongsun Biochemical Pharmaceutical Co., Ltd. is about to be completed, and its total production capacity will therefore reach a new level of 4000 tons, second only to the 5,000 tons of capacity of Ningxia Qiyuan Pharmaceutical. . Last year, the unit price and quantity of erythromycin thiocyanate exported from Ningxia Qiyuan Pharmaceutical ranked first in the country. The unit price for export of products was US$67-68 per billion units, a record high in recent years. This is because Ningxia Qiyuan Pharmaceutical has obtained the DMF certificate issued by the US FDA, so the product can be successfully exported to the markets of all countries in the world.

It is learned that Guangdong Zhaoqing Zhongheng Industrial Co., Ltd. plans to invest 2.697 billion yuan in a new 3,000-ton-grade erythromycin thiocyanate production line. If the company's production line can be put into operation within the next two years, it will certainly greatly ease the domestic supply of erythromycin thiocyanate. In addition, Sichuan Shanshan Pharmaceutical is also preparing a new erythromycin thiocyanate line with an annual output of 3,000 tons. Shandong Dongyao Pharmaceutical Company plans to invest 488 million yuan to build an erythromycin thiocyanate production line with an annual output of 1,500 tons.

There are also several small and medium-sized pharmaceutical companies in China, including Jiuzhou Pharmaceutical (an annual output of 200 tons), Henan Tianfang Pharmaceutical (an annual output of 140 tons), Tianjin Jipu Pharmaceutical (an annual output of 180 tons), and Shaoguan Jihui, Anyang City, Henan Province, China. The pharmaceutical industry (with an annual output of 300 tons) and the Hubei Remote Science and Technology Development Corporation (with an annual output of 300 tons) have a combined total production capacity of over 1,000 tons of erythromycin thiocyanate. At present, some of these companies are also investing in expanding their existing erythromycin thiocyanate production capacity. Corum Pharmaceutical announced on March 15 that the company will raise funds to build the world's largest antibiotic "Yaogu," which will produce erythromycin thiocyanate with an annual output of 4,800 tons of erythromycin. It can be seen that in the next three years, the output of erythromycin thiocyanate bulk drugs will reach a new level. (Author: Xu Zheng Kui)

IT02S Mini Tof Sensor Module Diagram

Parameters of IT02S:

IT02S – the High performance-price ratio measurement solution

* low power consumption of single transmit and single receive

* small size: 46*17*7mm

* low cost

* proffessional techinical support

The business club reported on March 22 that the tight supply of erythromycin thiocyanate and its increasing price trend, with the gradual expansion of the production of some manufacturers in place, the recent situation has been eased, the price has stabilized.